|

How to Register SSS Online

Online SSS Contribution Calculator

How to Compute Maternity Benefits

How to Compute Pension

Online SSS Pension Calculator

|

How to Compute Maternity Benefits

The maternity benefit is equivalent to 100 per cent of the member’s average daily salary credit multiplied by 60 days for normal delivery or miscarriage, 78 days for cesarean section delivery.

Basic Steps

Illustration:

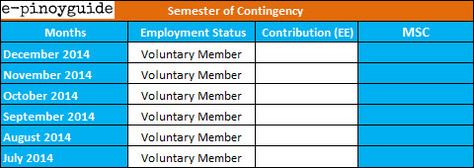

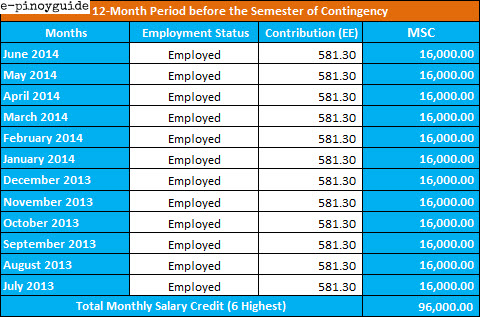

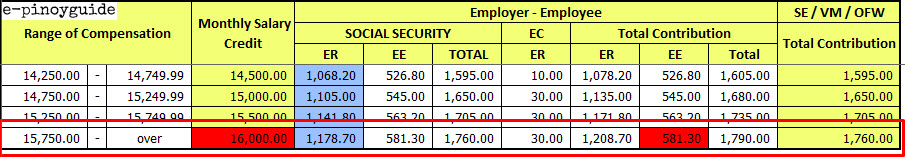

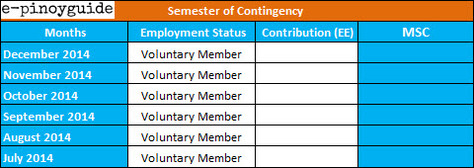

A member is giving birth in December 2014, with PhP 581.30 monthly contributions.

More Scenarios:

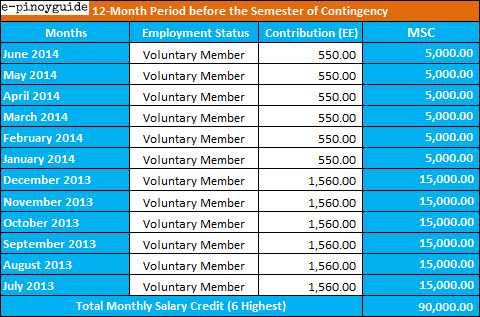

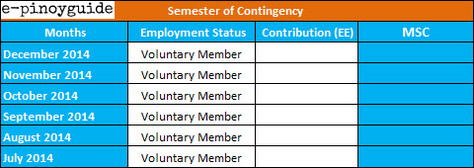

Scenario 1: If a Voluntary Member is giving birth on December 2014 and pays her premium payments from July 2013 to December 2013 that corresponds to the PhP 15,000 salary credit (that means, the member is paying the maximum monthly contribution as voluntary member - PhP 1,560.00 (based on the old SSS schedule), after which the member only pays 550.00 monthly contribution from January to June 2014 which is lower than her previous payments. The computation of her maternity benefit will be:

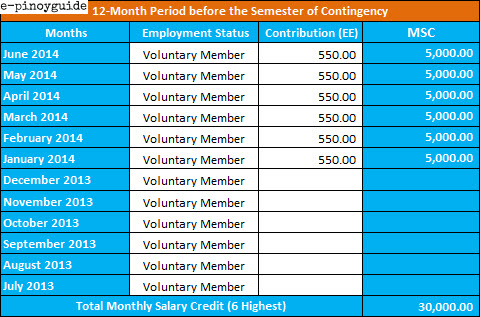

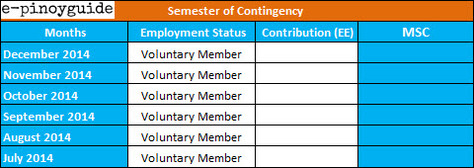

Scenario 2: If a Voluntary Member is giving birth on December 2014. The member missed premium payments from July 2013 to December 2013 but have payments from January to June 2014 with corresponding salary credit amounting to PhP 5,000 (or she has paid PhP 550 monthly) the computation will be:

Scenario 3: If Voluntary Member is giving birth on December 2014. She have premium payments from July 2013 to September 2013 with PhP 5,000 salary credit (that means she has paid PhP 520.00 monthly contribution, based from old SSS schedule). Then, for some reason, the member failed to pay for the succeeding months. The computation will be:

Note: As the requirement needs to have at least three (3) months contribution within the 12-month period preceding the semester of contingency, the member still qualifies for the benefit. Also note that, the higher your monthly contribution payment is, the higher maternity benefit you will get.

Free Online SSS Maternity Benefit Calculator

Try this online calculator to compute for your SSS maternity benefit.

Procedure:

Note:

For Employed Member: Contibutions under EE (Coulmn P) For SE/VM/OFW: Contributions under SE/VM/OFW (Column R) Get your corresponding contributions using the old and new SSS tables DISCLAIMER:

This online calculator is made available solely for the convenience of public. It follows the SSS schedule of contribution tables and is based on the author's own interpretation. It provides calculations based on the information you provide. All data entered are not stored. It is suggested, however, to clear your browser cache after completing your transaction. Should you find any inaccuracy, or have suggestions to improve this calculator, please throw it in here. Did you find this post helpful? Share this with your friends!

|